#5 Your Financial Habits Make (or Break) Your Wealth

Think you’re making all the right money moves? Think again.

Saving is great—until it backfires.

Side hustles sound smart—until they don’t pay.

Renting seems like a waste—until it actually builds wealth.

Here’s the thing, what we think we know about money isn’t always the full picture.

If you want to build wealth the smart way — not just the conventional way — keep reading.

Your Financial Habits are Making (or Breaking) Your Wealth

💡Want to think like the rich? These 16 financial habits can help you build and sustain wealth the smart way.

Emergency Funds 101: Why They Matter & How Much to Save

🚨 Be prepared for life’s surprises! This simple guide explains how much to save and why an emergency fund is a must-have.

Why Your Savings Account Is a Wealth Killer & What to Do Instead

⚠️ Can you save too much? Learn when excessive saving can actually hurt your financial growth—and what to do instead.

From $0 to $1,000/Month: A Side Hustle Roadmap

💼 Ready to boost your income? This step-by-step guide shows you how to build a profitable side hustle and make your first $1,000.

Airbnb vs Long-Term Rentals: Which Pays More?

🏠 Short-term or long-term rentals—which is more profitable? Compare Airbnb hosting to traditional renting and find out which strategy maximizes your income.

📖 THE INTELLIGENT INVESTOR

The timeless bible of value investing, written by Warren Buffett’s mentor, Benjamin Graham.

📉 The Big Idea: Successful investing isn’t about timing the market or chasing trends—it’s about analyzing fundamentals, managing risk, and thinking long-term. Graham introduces concepts like value investing, margin of safety, and ignoring market noise.

📊 Why It Matters: The stock market is a voting machine in the short term but a weighing machine in the long run. Understanding how to find undervalued assets and stay rational during market swings can help you build sustainable wealth.

🔍 Action Step: Focus on intrinsic value rather than short-term price movements. Learn how to read financial statements, evaluate companies, and invest with discipline instead of emotion.

🛁 Hot Take: If you can get through this book, you’ll probably be a better investor than 90% of people trading on hype. It’s not the easiest read, but neither is watching your portfolio crash because you YOLO’d into meme stocks.

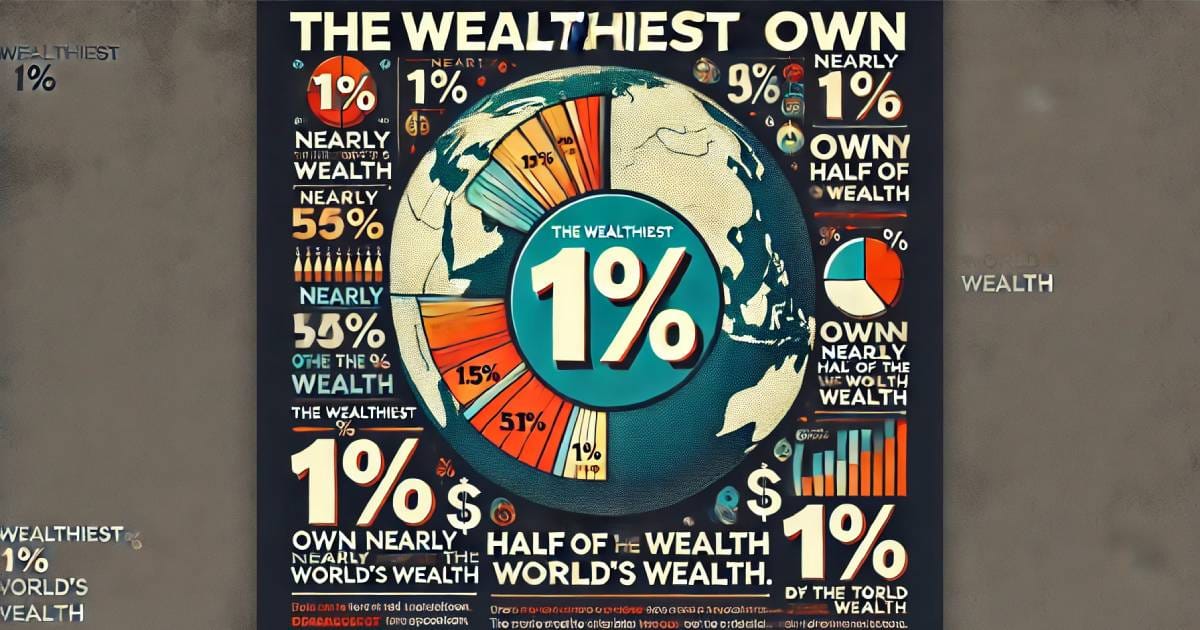

The wealthiest 1% own nearly half of the world's wealth

Wealth distribution is heavily skewed; understanding this can motivate personal financial planning.

If wealth were pizza, the top 1% took almost half the pie, leaving the rest of us to split the crumbs. Time to bake your own pizza!

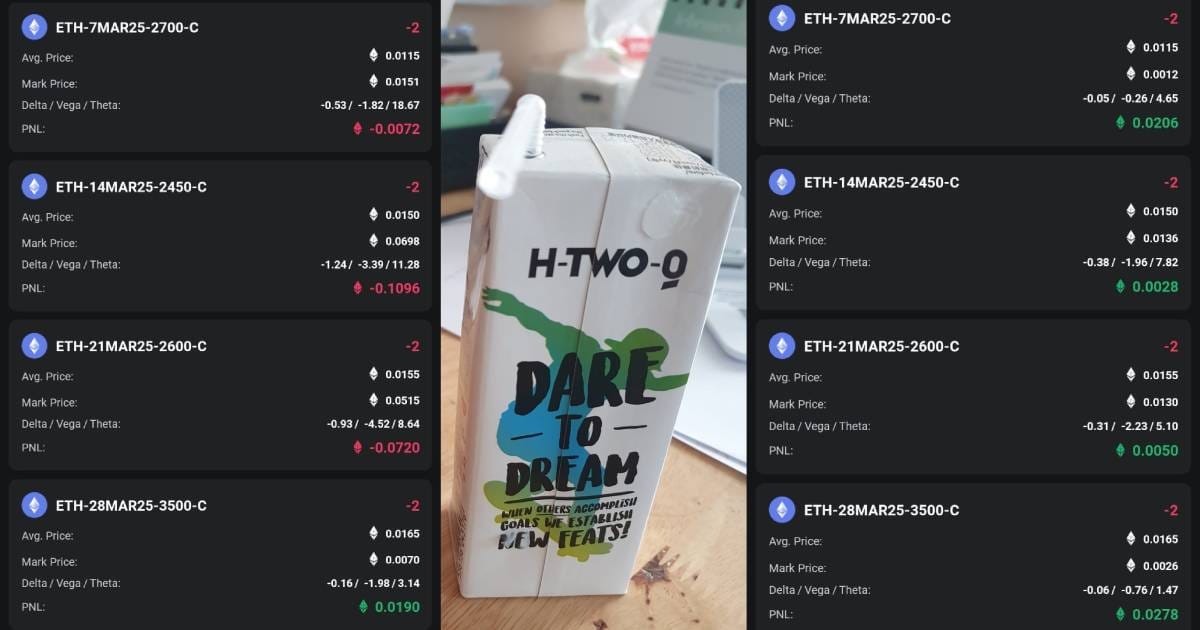

To the Moon... Or Back to the Drink: My Crypto Options Adventure!

Dipped my toes into crypto options some time ago.

Placed some trades, felt good, then opened up my account—bam! Mostly red.

My first instinct? Panic.

My second instinct? Grab a refreshing drink and pretend I didn’t just witness a financial crime against myself.

Decided to let it ride and check back the next day.

Lo and behold—green everywhere. Like magic.

Or, you know, market fluctuations doing their thing.

If there’s one thing I’ve learned from my small trading adventures, it’s this:

The market does what it does, and your job is to stick to the plan, not freak out at every red candle.

I got into crypto options to give my portfolio a little extra boost, but I also know this isn’t my all-in move.

It’s just a small slice of the pie, not the whole bakery.

Dream big, sure—but don’t bet the house.

Wealth-building isn’t about luck—it’s about strategy.

The good news? You don’t need to be a Wall Street genius to make it work.

You just need patience, persistence, and a willingness to say no to get-rich-quick nonsense.

So, whether you’re stacking cashbacks, flipping side hustles, or just trying not to impulse-buy another kitchen gadget, keep going.

Your bank account will thank you… eventually.

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃