#13 Toxic Money Habits of the Rich — How to Break Free?

Feeling stuck with your finances?

Discover insightful strategies on everything from avoiding costly mindset mistakes to negotiating your salary and automating your money.

Plus, get tips for preventing burnout and making smart real estate investments.

Ready to make smarter financial choices? Let's take the first step together!

The Toxic Money Mindset — How to Break Free?

🧠 Even millionaires can fall into a costly money mindset trap—learn how this common mistake can impact your wealth and discover ways to avoid it.

Salary Negotiation Hacks: Get Paid What You Deserve!

💼 Master the art of salary negotiation with proven strategies to confidently secure the compensation you deserve.

How I Automate My Finances to Grow on Autopilot

🤖 Set your finances on autopilot by automating savings and bill payments, making budgeting easier and more efficient.

Side Hustle Burnout? How to Avoid Turning Passion Into Pain

🔥 Discover strategies to avoid passion burnout, helping you sustain your drive and maintain work-life balance.

How to Invest in Property Without Buying a House

🏠 Discover how you can benefit from the property market without the traditional commitment of ownership.

🎬 ROGUE TRADER

A true story of a trader who brought down an entire bank with a series of risky, unauthorized trades.

📉 The Big Idea: The film portrays the rise and fall of Nick Leeson, a rogue trader whose unauthorized bets on the futures market led to the collapse of Barings Bank. It explores the dangers of unchecked power and how one person’s actions can bring down an institution.

📊 Why It Matters: It’s a stark reminder of the importance of proper oversight and risk management in financial institutions.

🔍 Action Step: Never underestimate the power of checks and balances—whether you’re trading stocks or managing personal finances.

🔥Hot Take: “Rogue Trader” is basically the ultimate 'hold my beer' moment in the finance world—when one guy thinks he’s invincible, but forgets that banks don't survive on vibes alone.

The First ATM: When Cash Came Out of a Wall

Before ATMs, getting cash meant banker’s hours and long lines. Then came a machine that spit out money.

Instant access to money is powerful—but it also makes impulsive spending easier. Build habits that protect your cash flow, not just your convenience.

The Cadillac and the Yogurt

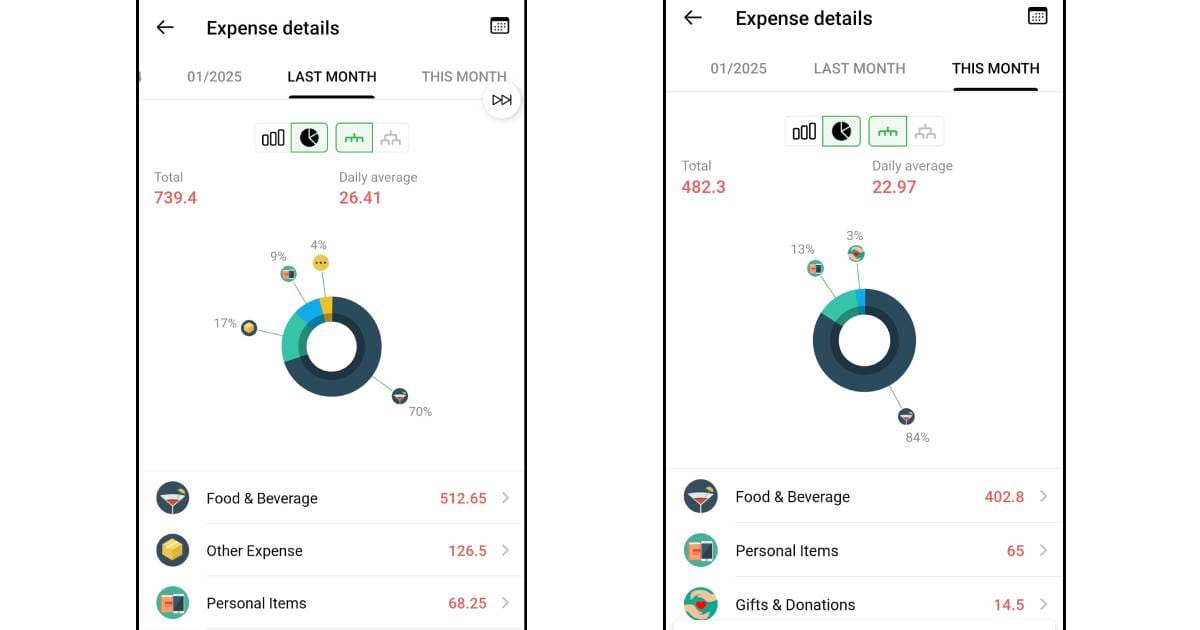

A while back, I stumbled upon a YouTube video of a super-disciplined 25-year-old tracking every cent she earned and spent—all in the name of buying a house for her and her mom.

Inspired, I downloaded an expense-tracking app too!

But my focus was on my own spending habits. Where does my money actually go?

Here’s the thing—being rich isn’t just about making big bucks; it’s also about keeping them.

Even Warren Buffett, a man worth billions, drove a 2006 Cadillac DTS for years until his daughter convinced him to upgrade… to a 2014 Cadillac XTS.

Even then, he opted for a modest 2014 Cadillac XTS instead of a luxury sports car.

His philosophy? “If it ain’t broke, don’t fix it.”

The man could afford a fleet of Ferraris, yet he can chill with an old Cadillac.

Maybe I should reconsider whether I really need that overpriced premium yogurt every day.

But let’s not get too radical—I still need probiotics to make smart financial decisions.

Now is the time to take charge of your financial journey.

Whether it's shifting your mindset about money, mastering salary negotiations, automating your finances, avoiding burnout, or finding innovative ways to invest, the key is taking consistent action.

Don’t wait for the perfect moment—start today.

Commit to your growth, stay focused, and watch how your financial future transforms.

It’s all within your reach—let’s make it happen!

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃