#6 Scarcity vs Abundance Mindset: Which One Are You Hoarding?

Ever feel like you’re working hard but getting nowhere financially?

The truth is, money isn’t just about numbers—it’s about mindset, strategy, and avoiding costly mistakes.

From breaking out of a scarcity mindset to making stress-free investments, these five key lessons can help you get ahead.

Start making smart money moves that actually work.

Scarcity vs Abundance Mindset: Which One Are You Hoarding?

👉 Transform your financial reality by shifting from a scarcity mindset to one of abundance! Discover how this pivotal change can unlock wealth and opportunities you never imagined.

Financial Red Flags: 10 Signs You’re One Latte Away from Disaster

👉 Is your financial ship veering off course? Uncover the 10 warning signs that signal impending disaster and learn how to steer back to prosperity before it's too late.

ETFs: Invest Without the Headache (Promise!)

👉 Tired of constant portfolio monitoring? Dive into the world of 'set it and forget it' investing with these top ETFs, and watch your wealth grow effortlessly over time.

Flipping for Profit: How I Made Money Selling Other People’s Stuff

👉 Turn everyday finds into cash! Learn the art of flipping items for profit with this beginner's guide, and start your journey to financial independence today.

REITs: The Lazy Investor’s Way to Own Property

👉 Ever wanted to invest in premium real estate without the hassle? Discover how REITs can make you a property mogul with minimal investment and maximum returns.

📖 MILLIONAIRE TEACHER

The personal finance class your school skipped—because who needs money skills when you can dissect a frog?

📉 The Big Idea: You don’t need a six-figure salary, stock market wizardry, or a lucky lottery ticket to get rich. You just need common sense, patience, and the ability to ignore financial "gurus" who want to sell you fancy investments. Hallam, a schoolteacher who built a million-dollar portfolio on a teacher’s salary, spills the real money lessons—like why frugality beats flexing, and why low-cost index funds are your best friend.

📊 Why It Matters: If you’re tired of working for your money and want your money to start working for you (without needing a PhD in finance), this book is your golden ticket. Hallam debunks financial myths, slaps overpriced mutual funds in the face, and makes investing feel doable—even if the only numbers you usually crunch are in your fast-food budget.

🔍 Action Step: Stop handing over your hard-earned cash to high-fee investment funds like a clueless tourist in a scammy souvenir shop. Instead, embrace the power of low-cost index funds, automate your investing, and let compound interest do its magic while you binge-watch Netflix guilt-free.

🛁 Hot Take: If a teacher can crack the wealth code on an educator’s salary, what’s your excuse? This book proves that building wealth isn’t about luck or privilege—it’s about making smart (and surprisingly simple) choices. A must-read if you’d rather retire comfortably than work forever just to pay for overpriced avocado toast.

Mona Lisa’s Heist: From Forgotten Painting to Priceless Icon

The Mona Lisa’s fame (and value) skyrocketed after it was stolen—proving that perception and storytelling can turn an asset into a fortune.

Wealth isn’t just about what you own; it’s about how the world sees what you own. Time to rebrand that garage clutter as “vintage investments”!

Time to Shop the Discount Rack!

This is the TradingView chart of SPY. SPY is a fund that tracks the S&P 500, representing the 500 largest companies in the U.S.

The 200 EMA (red line) is like SPY’s long-term compass—it shows the general direction of the market over time.

Traders also use the 50 EMA (green line) and 100 EMA (blue line) to track trends BUT the 200 EMA is the granddaddy of them all—it carries the most weight.

When SPY is above it, the market is healthy. When it's below, people panic.

But not me—I see discounts! As Warren Buffet wisely said,

The market loves to overreact, and this drop often means it's time to buy when others are running for the hills.

It’s like getting designer clothes on clearance—you know they’ll be trendy again soon.

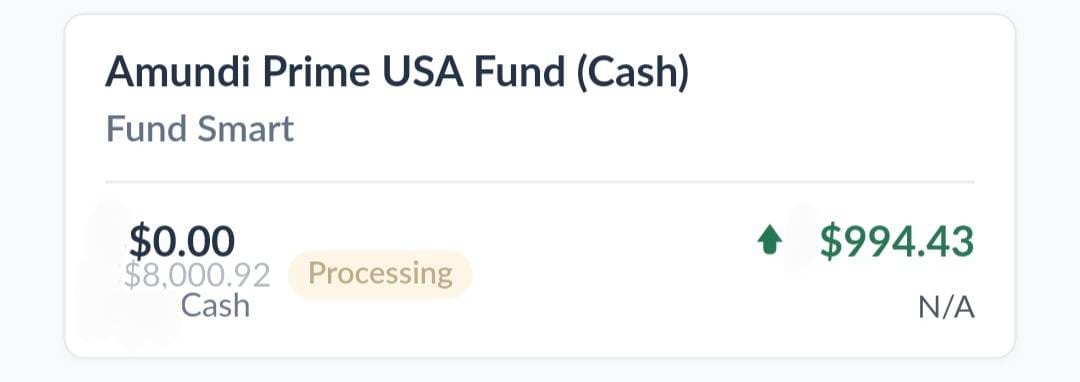

So, I did what any wealth-building geek would do—I threw $8,000 into Amundi Prime USA because, hey, history says it loves to bounce back!

Amundi Prime USA is like SPY’s cousin—it tracks the same S&P 500 index.

Will I be right? Only time will tell, but I like my odds!

By the way, if you’re thinking of buying individual stocks below the 200 EMA, beware!

It’s much riskier unless you have huge conviction in that company’s future.

Do your research before diving in—your financial journey should be your own!

That quote from Buffett isn't just something to nod at; it's a mindset shift.

Fear makes people freeze, but wealth-building happens when you make moves while others hesitate.

It took me some time to have that shift but I'm glad it happened.

If there’s one thing I’ve learned on this crazy wealth journey, it’s that progress isn’t about having a huge pile of cash just waiting for you to stumble upon it.

Trust me. I’ve looked!

It’s about taking tiny, sometimes awkward steps—like realizing that second-hand treasures can actually pay your bills.

So, whether you’re flipping items, diving into ETFs, or just trying to figure out the best way to own properties, remember: small wins lead to big ones.

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃