#50 Rain or Shine?

Welcome to this week's wealth buffet!

We’re serving up a wild mix today: why your cash might be rotting under the mattress, how a beach vacation explains complex crypto trading, and why a specific cat breed costs more than a luxury car.

Whether you're looking to buy property in London or just trying to figure out if the market predicts rain or shine, sit back—we’ve got the map to the treasure chest.

The Beachside Trader’s Secret: Are You Buying Umbrellas in a Heatwave?

I used to stare at crypto charts like they were written in invisible ink. Volatility? Sure, things moved fast. But where were they moving? Then I imagined myself on a beach.

I’m the vendor. I sell two things: umbrellas and sunglasses. Umbrellas represent put options—protection from the rain.

Sunglasses represent call options—gear for enjoying the blinding sunshine. If everyone on the beach is terrified of a sudden storm, they’ll pay anything for an umbrella.

Prices spike. If everyone’s hyped for a tan, sunglasses become the hot ticket.

That price gap between the two? That’s called skew—the emotional weather forecast of the market.

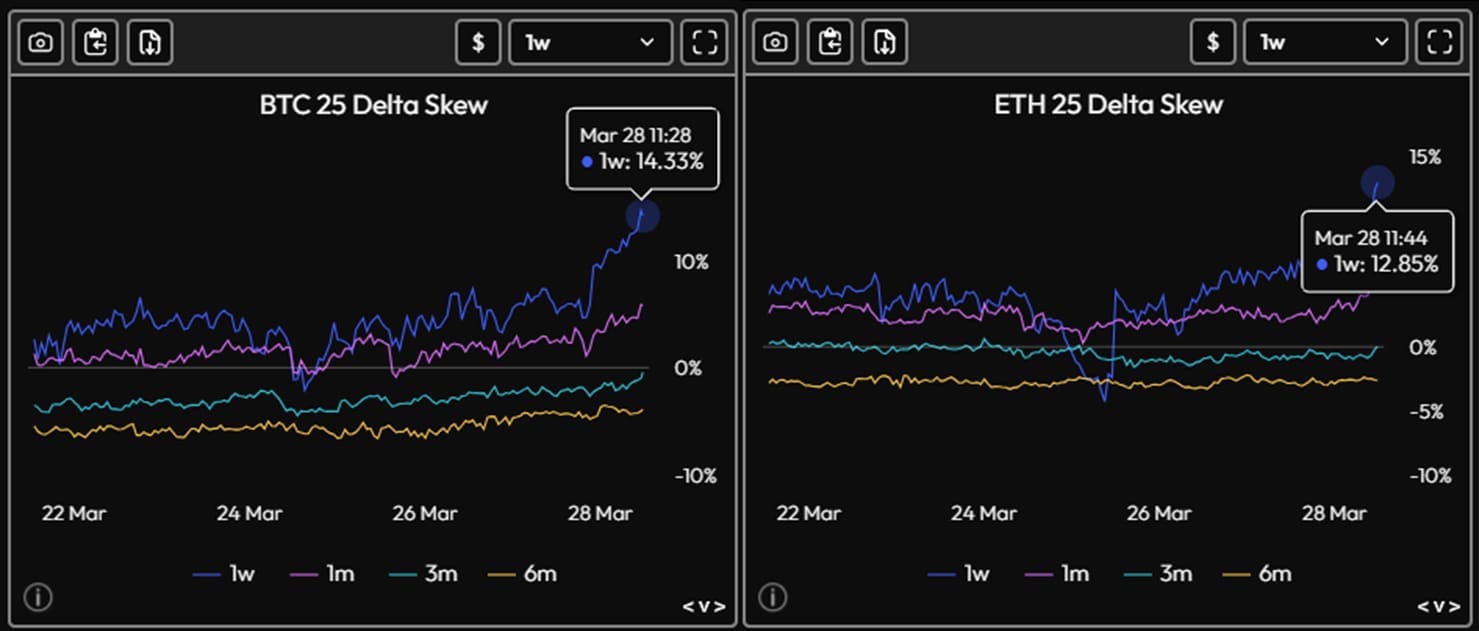

I checked the charts.

On March 28, Bitcoin’s one-week skew hit 14.33%, and Ethereum’s hit 12.85%.

That means traders were paying a premium for puts—more afraid of a drop than excited about a rally.

Umbrellas were overpriced. Sunglasses were cheap.

Before I understood skew, I was just watching volatility—like knowing the weather is “intense” but not knowing if it’s a hurricane or a heatwave.

Now I check the skew. If umbrellas are overpriced, I sell protection. If sunglasses are cheap, I buy sunshine.

Don’t be the guy buying sunglasses in a hurricane. Check the emotional forecast before you trade. Click on the Spotlight article below for more on delta skew.

By the way, if you're curious to explore the world of crypto options, I recommend checking out Crypto Knight Academy.

It’s where I began my own journey, and it gave me the foundation I needed. Decide for yourself if it’s the right fit for you.

If it resonates, you can sign up through this link for a special price. It could be the start of something empowering.

And here’s the bigger picture: skew isn’t just a trading trick, it’s a strategic shift.

As highlighted in the guide below on how rich people think, the wealthy don’t chase every storm or every ray of sunshine.

They build habits, protect their reputation, and act with urgency and discipline.

Applying that same millionaire mindset to crypto options means you’re not just reacting to market weather—you’re strategically positioning yourself for long‑term prosperity.

A free options workshop showing how investors use options to generate income, enhance returns, and manage risk in different market conditions.

8 Ways Rich People Think That Set Them Apart From The Crowd

🧠 Rich people don't trade time for money; they trade value for results. While the crowd focuses on saving pennies, the wealthy are obsessed with buying assets that print money while they sleep.

Hoarding Cash Might Be Hurting Your Future

💸 Cash under the mattress isn't safe; it's being slowly eaten alive by the silent killer known as inflation. If your money isn't working for you, it's actually quitting on you, one percentage point at a time.

Understanding the Significance of 25 Delta Skew in Options Trading

📉 Skew is basically the market’s mood ring, telling you if traders are paying more to protect against a crash or betting on a moonshot. Ignoring it is like trying to cross a busy street with your eyes closed—possible, but not recommended.

How to Turn What You Love into a Profitable Digital Business

🚀 Passion doesn't pay the bills until you package it into a product people actually want. Stop treating your skills like a free charity service and start validating your ideas to build a scalable income stream.

5 Most Popular Countries for Property Investment (& costs involved)🌏 Global real estate is calling, with Singaporeans flocking to Australia and the UK for stable returns. Whether you have $200k for a Thai getaway or $1.2m for a London flat, diversification is the name of the game.

Learn the secret to consistently earn $1K USD daily with a proven SRR & RSS forex strategy.

🎬 CAPITALISM: A LOVE STORY

A documentary that breaks up with the American economy—it’s not you, it’s the system.

🎯 The Big Idea: Michael Moore argues that the financial system is rigged to benefit the top 1% at the expense of everyone else, turning the American Dream into a bit of a nightmare for the working class.

💡 Why It Matters: It highlights the stark reality that financial literacy isn't just about getting rich; it's about self-defense in a system that prioritizes corporate profits over people's livelihoods.

🚀 Action Step: Don't just trust the system blindly—educate yourself on ethical investing and ensure your wealth-building aligns with your values so you aren't fueling the very problems you despise.

🔥 Hot Take: It’s like watching a horror movie where the monster is a bank ledger—scary, tragic, and unfortunately, based on a true story.

Talk about the purr-fect markup! This proves that price is often psychological; people aren't just paying for a pet, they are paying for exclusivity and a story that no one else has.

True wealth creation often comes from niche positioning—if you can turn a commodity (a cat) into a luxury brand (the Ashera), you can command margins that defy logic.

When I first started staring at charts and reading about "skew" and "delta," I felt small. I looked around and saw people making millions while I was trying to figure out what a "put option" was.

But here is the truth—everyone starts as a tourist in the land of wealth. The difference between the tourist and the local is just curiosity.

Whether it's understanding why traders are buying umbrellas (puts) or why a cat costs $125k, the secret is to keep asking "Why?" until the noise turns into a signal.

Don't be intimidated by the jargon. Put on your sunglasses, check the weather, and step into the market.

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃