#48 To Close or Not To Close

Welcome to the first issue of the year! 🎉 Be sure to read to the very end to claim your special gift!

We’re diving into the wild world of wealth-building, from smart trading strategies to mindset shifts that actually move the needle.

Think of this as your guide to navigating the chaos—and picking your own wealth nuggets along the way.

Options Zoo Getting Too Crowded? Meet… the Synthetic Unicorn.

In the world of options, we’ve got a whole zoo: Bull call spreads, bear puts, iron butterflies, iron condors… basically every animal except the one you actually want to cuddle.

And just when I thought I had seen every creature in the options safari, I met another one — the Synthetic.

Imagine dressing up like you own a stock when you actually don’t. That’s a synthetic.

It’s basically the Clark Kent of options: glasses on, nobody knows it’s actually Superman.

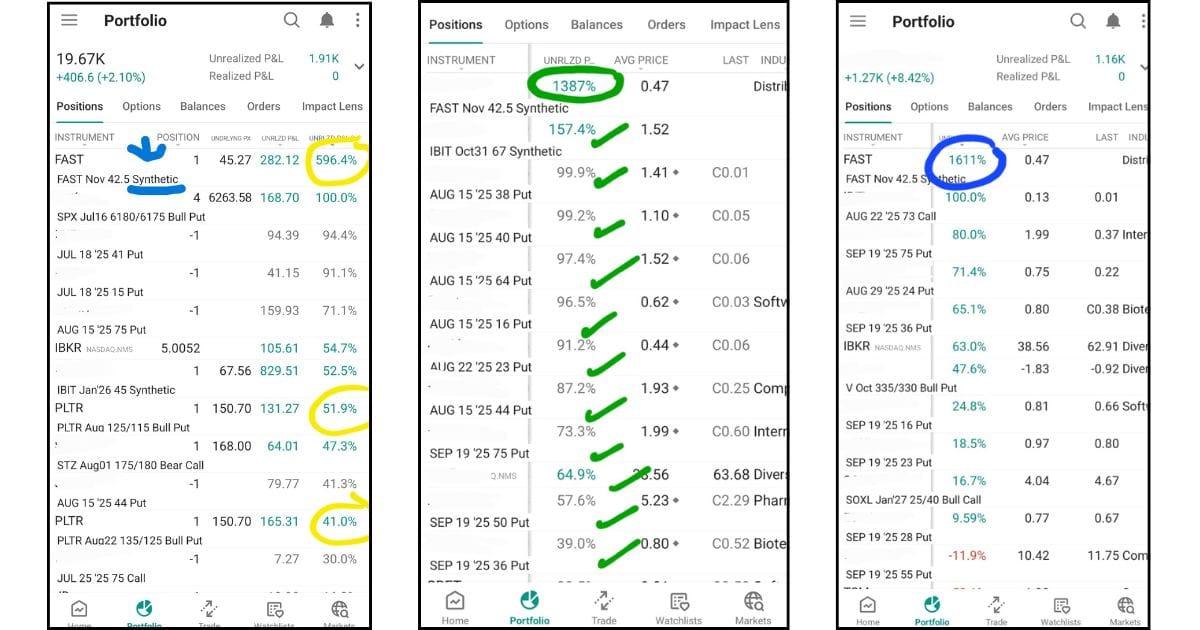

So here’s my little adventure. I didn’t pull a fast one on FAST (Fastenal Company) — a solid, steady industrial supply giant that keeps America’s factories, workshops, and construction sites running smoothly.

Nothing fancy, no hype, just a company with consistent demand and growth… and yes, I saw potential. A slow-and-steady-wins-the-race kind of stock — the tortoise that refuses to nap.

So what did I do? I put on a long-term synthetic position:

- Long call

- Short put

Boom — synthetic long stock, minus actually holding stock.

And because I’m me, I didn’t just stop there. I decided to sell calls against it — squeezing out monthly premiums like I’m juicing an orange for every drop of vitamin C.

At one point, the synthetic itself went up 1611%.

Yes, I triple-checked.

Yes, I screamed internally.

Yes, I considered screenshotting it and framing it in my living room.

Here’s where every trader becomes a philosopher. ”To Close or Not To Close… That’s the Million-Dollar Juice Debate.”

Do you:

✔️ Close it and lock in the big gain?

or

✔️ Keep milking… I mean, collecting premiums until expiry?

Me? I squeezed that synthetic like it owed me money — all the way until the last month of expiry.

But honestly, everyone’s strategy is different. There’s no right or wrong — only what aligns with your goals, risk appetite, and how dramatically you gasp at drawdowns.

If you’re curious how traders (and anyone on a wealth journey) make these decisions without flipping a table every week, the spotlight article below may help.

It dives into why money strategies only get you halfway — and the other half is how you think, react, and stay grounded while navigating your own options zoo.

A short daily shift in how you think, work, or see the world.

Financial Freedom Starts in Your Mind

💡 Why do some passive investors stay zen while others panic at every dip? Because financial freedom starts in your mind, not your portfolio.

The Ultimate Options Cheat Code to Replicate Any Position

⚔️ Discover the simple formula traders use to mimic stock positions with less capital, giving you the same movement without the same cost.

33 Tricks to Make Your Day 10x More Productive

⏱️ Learn why multitasking destroys your focus and how simple habits can instantly sharpen your workflow. These tiny shifts help you get more done in less time, without the burnout.

The Digital Gold Rush: 5 Ways Content Creators Rake in Cash

💰 See how creators are earning beyond ads with new, scalable digital income streams. Subscriptions, digital products, and automated systems are becoming the next big cash machines.

Why Healthcare S-REITs Are the Retirement-Proof Hidden Gem

🩺 Find out why Singapore’s ageing boom is turning this REIT sector into a quiet powerhouse. Stable leases and essential demand make it a defensive investor’s dream.

Discover the TAD System—a high-win-rate Forex strategy built for daily gains, minimal stress, and fast execution. Trade less, earn more, and break the rules.

🎬 THERE WILL BE BLOOD

A thrilling ride into the dark heart of American ambition and the destructive nature of unchecked greed, starring Daniel Day-Lewis as the oil man who just wants to drink your milkshake.

🎯 The Big Idea: The movie is a raw commentary on the corrosive power of unfettered capitalism and how the ruthless, single-minded pursuit of wealth can completely destroy a man’s soul, family, and everything else he touches.

💡 Why It Matters: It’s a chilling reminder that the end goal of wealth is freedom, not just accumulation. Don't let your pursuit of "The Deal" turn you into a sociopathic oil magnate who finishes his life drinking alone in a mansion's bowling alley.

🚀 Action Step: Define your "enough" number. Knowing when you have enough to be happy can save you from the moral and financial drawdowns of trying to own the entire oil field.

🔥 Hot Take: Forget "I drink your milkshake." The real finance lesson is Daniel Plainview’s sheer genius for vertical integration and pipeline control—he just had the worst bedside manner in history.

Why Virtual Real Estate is Suddenly a Billion-Dollar Conversation

Virtual real estate is digital land on a blockchain-based metaverse system, and each parcel is a unique NFT (Non-Fungible Token) that verifies your ownership.

Just like the real world, location is key in the metaverse—land next to major brands or high-traffic areas commands a premium, making utility a major driver of value.

As we step into a new year, let’s bring along an attitude of gratitude for the lessons, wins, and even the missteps that got us here.

I’ve put together Wealth Potpourri Mini Wealth Digests from last year—bite-sized nuggets of strategy, mindset, and inspiration for your journey.

Pick what resonates, spark those financial neurons, and remember: progress beats perfection every time.

Here’s to 2026 — a year of bold moves, steady growth, and joy in the journey!

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃