#29 The Power Of Patience

If there’s one thing wealth-building has taught me, it’s this: fast isn’t always better.

This week’s picks explore the power of patience, smart investing, and even how digital monetization through YouTube can be more than just cat videos.

Whether you like slow compounding or fast trades, there’s something here for every wealth explorer.

When Profits Turn Into Promises: My Bear Call Spread Rollercoaster

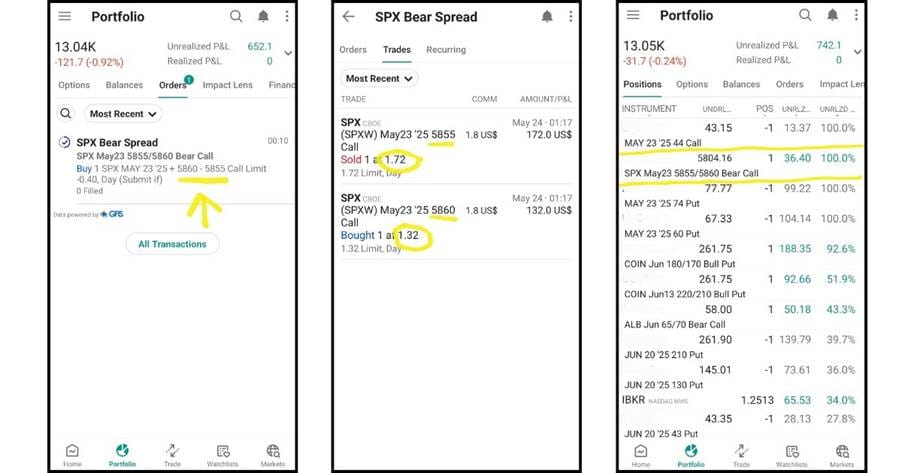

Upon receiving a live trade signal, I executed a classic 0 DTE bear call spread—a strategy I spotlighted in a recent newsletter issue.

Good news: it ended in profit! Here’s how it played out:

|

🔧 Trade

Strategy |

💼 Bear Call

Spread |

|

Step 1 |

Bought a call option at $132 |

|

Step 2 |

Sold a call option at $172 |

|

Credit Received |

$40 (from the premium difference) |

|

Final Profit |

$36.40 after platform fees and commissions |

What’s a Bear Call Spread? It’s an options strategy where you bet a stock won’t rise above a certain price. You sell a lower-strike call and buy a higher-strike call. This means you collect a credit upfront. On expiry, if the stock stays below the strike you sold, you keep the profit.

$36.40 is the profit from just 1 options contract. Now imagine your portfolio is big enough to handle 10 contracts—suddenly that’s $364 in a single day.

Sounds exciting, right? But here’s the catch: profits don’t happen by luck. To win consistently in options trading, you need a clear, disciplined strategy—not just bigger bets.

That trade wasn’t based on hope or hunches—it was powered by quant research. And that’s where Super Investor Club comes in.

Every signal is driven by data and mathematical models. No fluff, no guesswork—just statistical edge and disciplined execution.

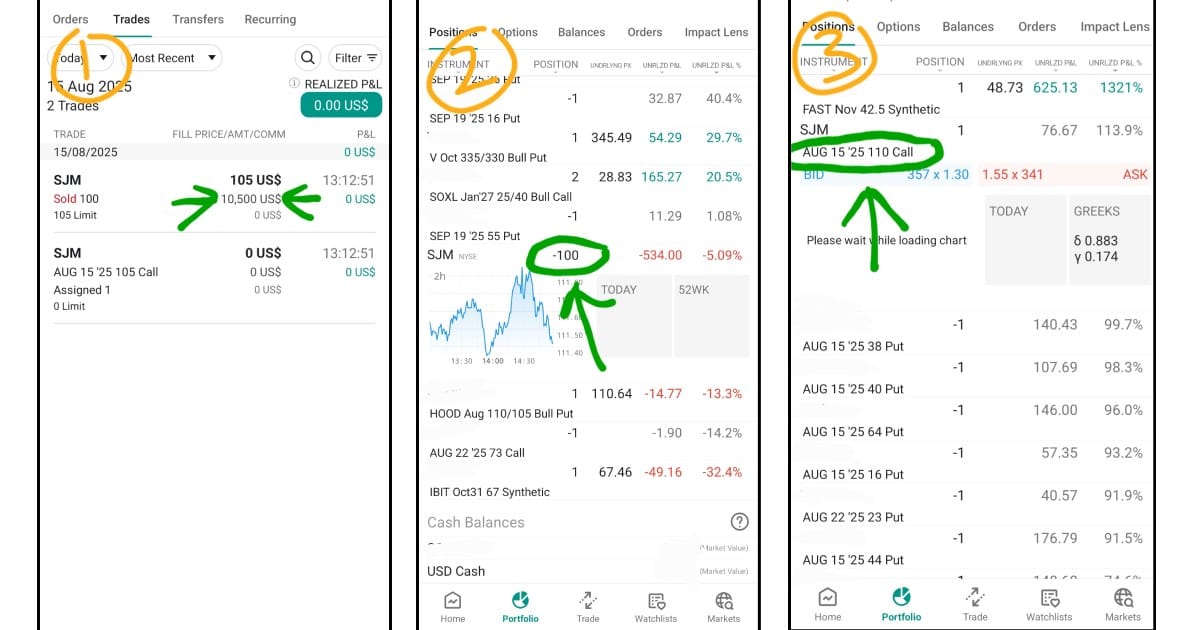

Another bear call spread adventure — and this one came with a $10,500 surprise.

A month ago, I placed a bear call spread on a stock. I sold a call at strike $105 and bought a call at strike $110. Fast forward to one day before expiry, I opened my account and saw I was suddenly $10,500 richer!

Before I got too excited, I realized what had happened: I was assigned on my short call option. See picture 1. Someone exercised their option against me, which meant they forced me to sell them 100 shares of the stock at $105. Since the stock was trading higher than that, they could then sell at a profit.

The problem? I didn’t actually own 100 shares. Picture 2 makes it clear—I owed 100 shares. In options language, that’s called being short: I’ve borrowed shares to sell them.

But remember, this was a bear call spread, so I still had the buy call leg as protection. See picture 3.

When the market opened the next day, here’s what I did:

- I bought 100 shares to cover the short position.

- I closed my buy call to fully exit the spread.

Since the underlying price was already above $110, the trade ended in a loss—but it was a loss I could handle, because I already knew the maximum risk before placing the trade. I did not want to leave anything to chance.

Now, let’s look at the “what ifs.”

If I had waited for the stock price to drop before buying the 100 shares:

- Pro: I could have bought them back cheaper and made extra profit.

- Con: If the price went up instead, my losses would have grown quickly, and the stress would be huge.

If I had not closed my buy call right away:

- Pro: If the stock went up, my buy call would have gained value, giving me extra cushion.

- Con: If the stock stayed flat or went down, that buy call would lose value. Plus, time decay would eat away at it. In short, it would be more like gambling than risk management.

I like to invest in my own knowledge first—that way, the profits have a fighting chance.

As mentioned, one community I lean on for smart trade ideas is Super Investor Club. The members get:

- ✅ Weekly lessons on advanced trading techniques

- ✅ Curated resources to deepen your strategy toolkit

- ✅ Live trade signals you can act on instantly

- ✅ Exclusive Telegram access for real-time updates

Best part? You can try it free for 2 weeks—and if you stay, it’s just $1.30/day. That’s less than your morning coffee.

It’s not about trading every day—it’s about trading smart, and letting the numbers lead the way.

Ready to plug into trades that make sense—and profits that add up?

Start your free trial at Super Investor Club and begin trading with data-backed confidence.

Curating the best side hustles for hustlers everywhere! Subscribe to Side Hustle Weekly for weekly updates on past successes and future opportunities.

The Power of Patience in Building Serious Wealth

🕰️ Time isn’t just money — it’s a secret weapon. This deep dive shows how small, steady gains snowball into serious wealth over years.

Saving vs Investing: Where Should Your Money Go?

💵 Not sure whether to stash or grow your cash? This guide breaks down the key differences so you can make smarter money decisions.

What Are 0-DTE Options?

⚡ High risk, high reward — 0-DTE (zero days to expiration) options offer quick trades but demand strategy. Great if you like adrenaline and math.

How to Start and Grow a YouTube Channel in 2025

📹 YouTube isn’t just a hobby anymore — it’s a business. Learn how creators are turning content into passive income with the right playbook.

Flipping vs. Long-Term Investing: Which One Builds More Wealth?

🔄 Quick flips or long hauls? This breakdown compares returns, effort, and risk — and why sometimes, slow and steady wins the race.

Gain insights into business and investing from the founder of a successful holding company.

🎬 THE SOCIAL NETWORK

The fast-paced drama about the rise of Facebook and its founder Mark Zuckerberg, who went from college student to billionaire entrepreneur overnight.

📉 The Big Idea: Dive into the messy world of tech startups, friendships, and legal battles as Zuckerberg navigates success, betrayal, and the creation of a social media giant.

📊 Why It Matters: This film exposes how innovation and ambition collide with ethics and relationships—reminding us that success often comes with complex costs.

🔍 Action Step: Dream big, build fast, but don’t forget the people who helped you get there. Balance ambition with integrity.

🔥 Hot Take: It’s like watching “Silicon Valley” drama unfold in real life — with a killer soundtrack and legal drama to boot.

Diamonds in the Dumpster: When Wealth Hits You in the Trash

Sometimes, your big break isn’t in a boardroom—it’s buried in a burnt pile of rubbish. One man’s trash is another man’s down payment.

Before you throw out that old drawer of tangled cables and mystery keys… maybe give it one last look. Financial freedom might be hiding under the toaster crumbs.

Fast moves can be exciting — but slow, steady steps often win the wealth game.

Whether you're letting compound interest work its magic, trading with guidance or uploading your first YouTube video, the goal is momentum.

Which one of these ideas will you start today?

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃