#11 Why Rich People Keep Learning (and You Should Too!)

Ready to break free from financial struggles?

It’s time to get smart about money, strategy, and mindset.

From mastering budgeting to passive income, these tips will guide you to a wealthier future.

Get the full scoop and take control of your finances!

Why Rich People Keep Learning (and You Should Too!)

💡 Learn the essential traits and strategies that successful people use to build lasting wealth, from mastering time management to embracing calculated risks. Cultivating these skills can set you on a similar path.

Tracking Your Money: The Power of Monthly Finance Reviews

💰 Budgeting is key to financial stability. This guide shows how a simple monthly review can help track spending, adjust goals, and ensure you're staying on top of your finances.

Retirement? Bad Idea to Build an Income Producing Portfolio

📈 Explore various ways to create a portfolio that generates passive income, focusing on a mix of stocks, bonds, and real estate investments.

Passive vs Active Hustles: Which One is Right for You?

💼 Should you focus on a side hustle or build passive income? This article compares the two paths and helps you decide which is best for your financial goals.

Real Estate 101: Buy Property, Not Trouble!

🏠 A beginner’s guide to entering the real estate market, from buying property to considering REITs. Learn how to start without being overwhelmed.

🎬 MARGIN CALL

The movie that shows you just how fast everything can crash when high-stakes finance meets greed and poor decisions.

📉 The Big Idea: A 24-hour period at an investment bank during the 2008 financial crisis, where one rookie's discovery reveals the impending collapse, forcing a desperate scramble to cover it up. It's all about the consequences of risk, blind ambition, and the choices that determine the fate of the financial world.

📊 Why It Matters: If you think the financial crisis was a fluke, this movie will remind you how fragile everything is, especially when people’s egos and money are on the line.

🔍 Action Step: Maybe it’s time to read the fine print before signing up for that risky investment or consider a less volatile financial path.

🔥 Hot Take: “Margin Call” is like watching a financial disaster unfold in real-time, and while it may be a bit too late for the characters, it’s not too late for us to learn from their mistakes.

Diamonds: The World’s Most Expensive Common Rock

Scarcity drives prices, but marketing can do wonders too.

The real gem is knowing when to invest in hype and when to walk away.

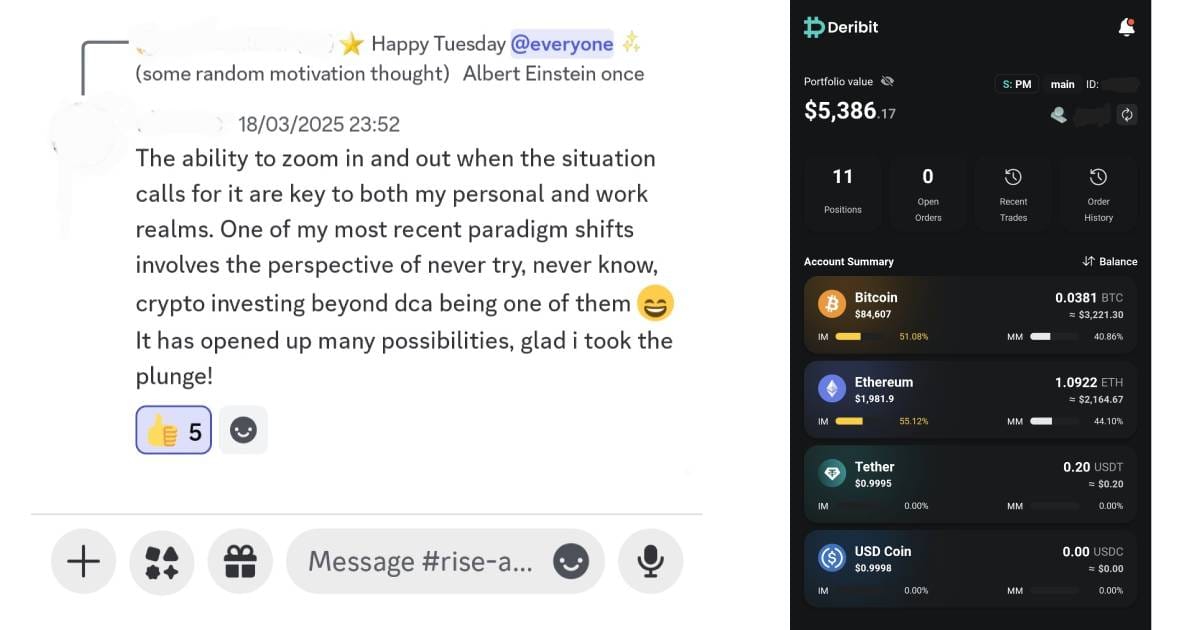

The Wealth-Building Paradigm Shift

A crypto options trader shared his experience recently, and it totally hit home for me.

I thought, why not take the plunge and make my money work hard?

So I invested in educating myself and joined a crypto trading community before getting started.

Instead of just doing DCA (dollar cost averaging) and holding crypto like a sleepy bank account, I started trading options with proper portfolio sizing and risk management.

In just six months, my portfolio grew almost 40% to $5,386!

I’m not saying I’m the next crypto genius, but hey, using options to earn premiums along the way is definitely a faster wealth-building hack than waiting for my bank to toss me a few pennies in interest.

Have you thought about how a little shift in your strategy could shake up your financial future?

What’s stopping you from venturing out of your comfort zone to build wealth?

If there’s one thing I’ve learned from diving deep into wealth-building, it’s that success isn’t about the big, flashy moves.

It’s about the small, intentional steps—like budgeting, finding the best ways to make passive income, or mastering the skills of the wealthy.

Consistent progress always pays off.

Stay focused on the long-term and keep taking those baby steps.

Soon, you’ll be seeing the rewards of your hard work!

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃