#22 How to Stop Losing Sleep Over Losses

Money isn’t just about numbers—it’s about mindset, strategy, and making choices that shape our future.

Whether it’s overcoming loss aversion, embracing freeganism, or setting financial goals, every decision we make has a ripple effect.

Let’s dive into some powerful insights that can help you rethink wealth, opportunity, and financial freedom!

How to Stop Losing Sleep Over Losses

💰 Loss aversion can hold investors back, making them overly cautious or prone to panic selling. Learn how to shift your mindset and make smarter, more confident investment decisions.

Freegan Lifestyle: Frugal, Not Poor

♻️ Freegans aren’t just about saving money—they’re about reducing waste and making sustainable choices. Discover how this movement is reshaping consumer habits in Singapore.

Award-Winning 4-Step Goals-Based Investing Strategy

📈 Traditional investing focuses on beating benchmarks, but goals-based investing prioritizes real-life financial objectives. Learn how a four-step framework can help investors achieve meaningful goals.

10 Side Hustles You Can Start This Weekend (No Experience Needed)🚀 Want to boost your income fast? From freelancing to flipping items, these side hustles can help you start earning extra cash in just a few days.

The Ultimate Landlord Checklist: Before Renting Out a Home

🏡 Renting out a property? Make sure you’ve covered all the essentials—from safety checks to tenant screening—to protect your investment and ensure a smooth rental experience.

Weekly insights for business leaders, based on what we’re learning from over 500 companies, global market trends, and real-world growth experiments.

🎬 MONEYBALL

A deep dive into how data-driven decision-making revolutionized baseball, challenging traditional scouting methods and proving that smart strategy can outperform big budgets.

📉 The Big Idea: Billy Beane, the Oakland A’s general manager, defies baseball’s old-school scouting system by using analytics to build a competitive team on a tight budget. His approach reshapes the game and proves that undervalued players can deliver big results.

📊 Why It Matters: Moneyball isn’t just about baseball—it’s about challenging outdated systems and finding hidden value where others don’t. The lessons apply to business, investing, and life: data-driven decisions can beat conventional wisdom.

🔍 Action Step: Think beyond tradition. Whether in sports, finance, or career moves, look for overlooked opportunities and use logic over emotion to make smarter choices.

🔥 Hot Take: Moneyball is like watching a scrappy startup take on corporate giants—except instead of tech, it’s baseball, and instead of algorithms, it’s stats that make the underdogs unstoppable.

A daily Bitcoin-only newsletter that cuts through the noise, giving you the most valuable insights to help you take control of your financial future.

The World's Most Expensive Postage That Won’t Mail a Thing!

Rarity and history can make tiny objects worth millions.

Maybe start checking your old mail—your bills might not be the only thing valuable in that pile.

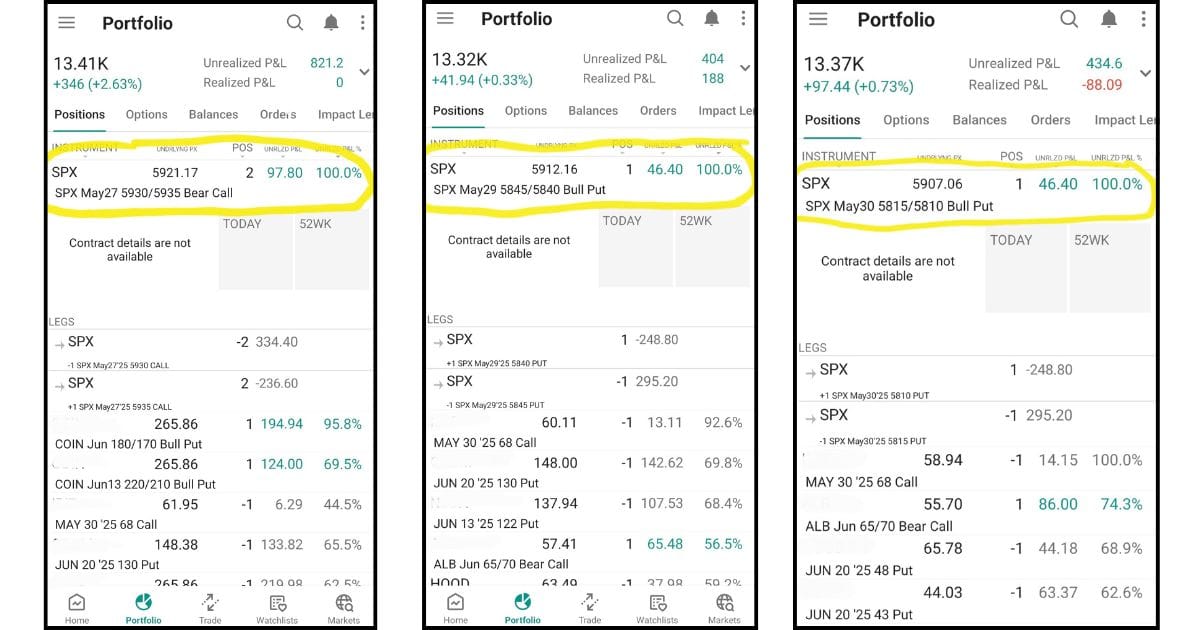

Gamma Exposure & 0 DTE Trades

Last week, we explored the Kelly Criterion, a powerful strategy for managing risk and optimizing bet sizing.

This week, we’re diving into gamma exposure—an essential concept for 0 Days to Expiration (0 DTE) options trading.

Gamma exposure plays a crucial role in 0 DTE options trading.

Since these options are highly sensitive to price movements, gamma helps traders anticipate rapid shifts in delta, allowing for precise risk management and strategic positioning.

Recently, a few of my 0 DTE trades added up to a profit of $190.60—enough to treat my family to a really good meal!

This reinforces how data-backed strategies can lead to consistent, measurable gains when executed with precision.

At the Super Investor Club, research is driven by data and quantitative analysis to maximize win probability.

It’s called quant research—the use of mathematical models, historical data, and algorithmic strategies to identify profitable trading opportunities.

This approach eliminates guesswork and focuses on fact-based strategies that lead to consistent, real-world profits—no fluff, just results.

If you value fact-based research that translates into real strategies, this is the place for you.

Currently, Super Investor Club offers a free 2-week trial and a special discount for new members.

As part of the monthly subscription, you’ll get:

✅ Weekly lessons on advanced trading concepts

✅ Curated online resource hub on trading strategies and tools

✅ Live trade signals to guide your decisions

✅ Exclusive Telegram group access for real-time insights

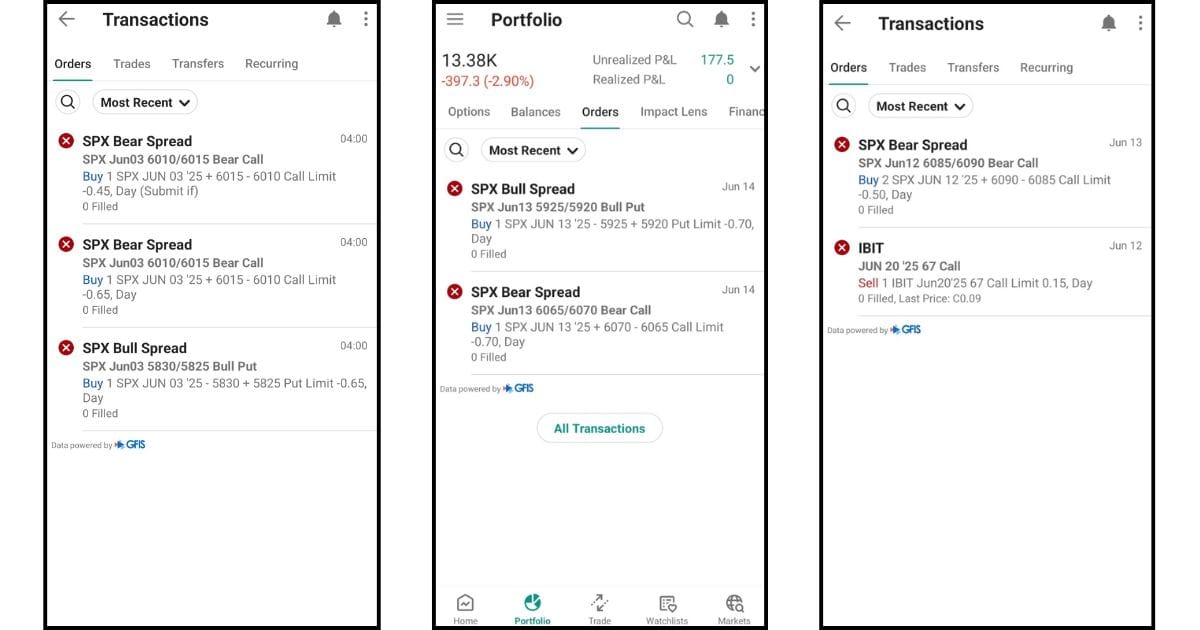

Trading isn’t about overnight success—it’s about steady, data-backed growth. You won’t trade every day; instead, you’ll follow what the data says to maximize returns over time.

Here’s proof: these are my trades that didn’t go through, reminding me that selectivity and patience matter just as much as the wins.

If you’re ready to take control of your financial future, this could be the first step toward something bigger.

Take the leap—you may end up surprising yourself, just like I did.

Next week, we’ll dive into how being a faceless YouTuber can open up a new income stream — perfect for introverts who want to create without showing their face!

Stay tuned!

Years ago, I found myself stuck in a cycle of hesitation—afraid to take risks, afraid to invest, afraid to step outside my comfort zone.

But driven by the want to give my family a better life, I decided to break free from my fears and take action.

That’s why I started this newsletter—to empower people to explore different income streams, and make more confident financial decisions. Knowledge is power.

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃