#49 I Found It

Welcome to a "Jurassic" edition!

From dinosaur graveyards to renting out microchips for monthly cash—we’re exploring fossils, chips, and financial hacks.

Plus: aligning your wallet with your why, paycheck‑style Wheel strategies, smarter sponsorships, creator‑economy wins, and the hard truth on housing.

Because wealth is never a straight line—it’s an adventure.

Riding the Options Wheel to Monthly Cash

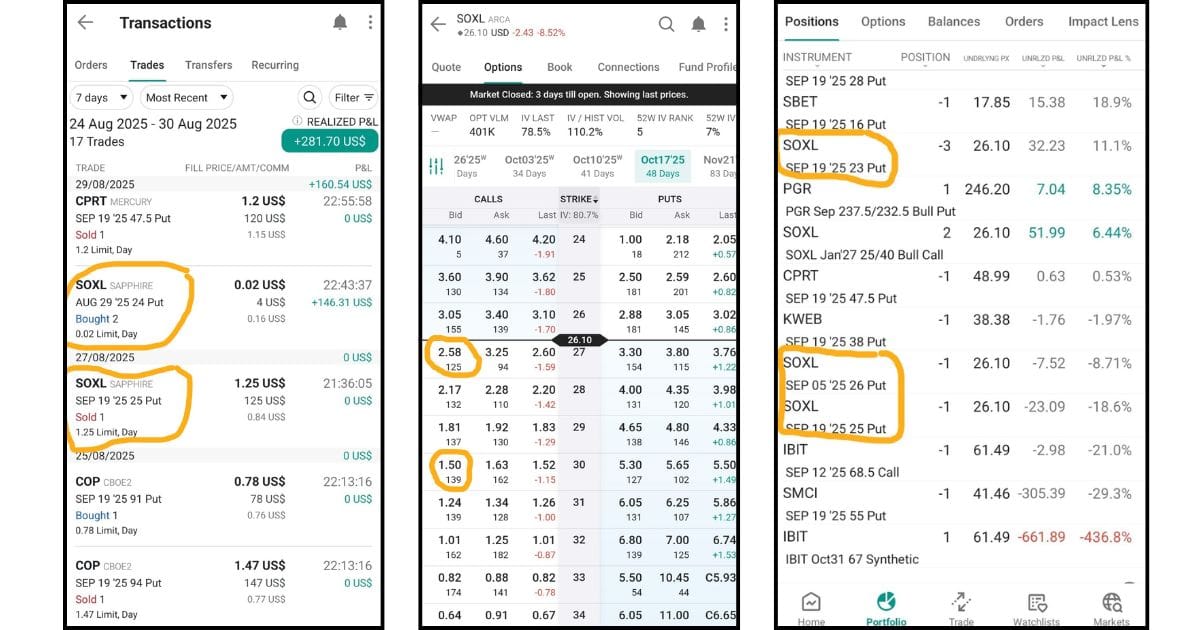

I have a confession: I’m flirting with SOXL.

For the uninitiated, SOXL (Direxion Daily Semiconductor Bull 3X Shares) is an ETF that moves at triple the speed of the semiconductor market.

It’s the financial equivalent of dating a supermodel who drinks five espressos before breakfast—exciting, volatile, and potentially very rewarding if you can handle the mood swings.

Here’s the game plan: The Wheel Strategy. Think of it like being a landlord, but instead of a condo, you’re renting out shares of high‑tech companies.

Step 1: The "Waiting Fee" (Selling Puts)

The month is August. I look at the chart. I decide I’d be happy to own SOXL at $25. But instead of buying it now, I sell a Put option for a future date (Sep 19, 2025).

Translation: I promise to buy the shares at $25 on that date.

The Perk: The market pays me a "premium" (cash upfront) just for making that promise. I’m getting paid to wait.

Step 2: The "Rent Collection" (Selling Calls)

Fast forward. It’s September 2025. The price dipped, and I now own the shares at $25. Great! Now I switch sides. I sell a Call option for the next month (Oct 17).

Translation: I agree to sell my shares if they hit a higher price, like $30.

Perk: I collect another premium. This is my "monthly rent."

The Dilemma: Do I choose the $27 strike price for a juicy $2.58 premium? Or the $30 strike for a safer $1.50 premium?

Option A ($27): Higher immediate cash, but my shares might get sold ("called away") sooner. I profit $200 on the stock growth + the big premium.

Option B ($30): Lower immediate cash, but I get to keep the shares longer and ride the wave up.

There’s no wrong answer, just different flavors of profit. But here’s the truth: if you don’t know your big WHY, even the best strategy can feel like chaos.

Because dating a volatile supermodel like SOXL is thrilling, but without a deeper purpose, the mood swings will eat you alive.

The Wheel Strategy isn’t just about generating income whether the market is boring, crashing, or zooming—it’s about aligning your wallet with your why.

Curious?

Check out the spotlight article below for the technical breakdown—and for a reminder that the strongest portfolios aren’t built on adrenaline, they’re built on purpose.

Different investors, different strategies, one event that could change the way you invest forever. We're bringing together top investors from every major asset class, stocks, options, forex, crypto, real estate for one powerful live session.

Aligning Your Wallet with Your Why

💡Ever wonder why your budget fails? It’s usually because your spending is filling a void, not a purpose—time to align your cash with your soul.

Complete Guide to Wheel Options Trading Strategy

🎡 The "Buy Low, Sell High" strategy on steroids—this guide breaks down how to turn stock ownership into a monthly paycheck machine.

6 Critical Strategies for Sponsorship Negotiation

🤝 Stop begging for money and start offering value; negotiation is just professional dating, and desperation is never attractive.

How to Make Money on TikTok, YouTube & Instagram

📱 The creator economy is booming—TikTok pays better, YouTube is king, and you don’t even need to know how to dance to cash in.

Global Investment Outlook

🏠 Markets are shifting again — discover where smart global investors are placing capital before the next real estate cycle accelerates.

📖 THE LAUNDROMAT

A dark comedy that peels back the layers of the global financial onion, only to find it’s rotten at the core.

🎯 The Big Idea: The book exposes the complex, murky world of shell companies and offshore accounts (specifically the Panama Papers scandal), showing how the ultra-wealthy hide their money in plain sight.

💡 Why It Matters: It reveals that the financial game is often rigged by those who write the rules. Understanding "tax avoidance" vs. "tax evasion" might just save your assets—or at least help you understand why your insurance claim was denied.

🚀 Action Step: Audit your own financial partners. If an investment opportunity involves a PO Box in a country you can’t find on a map, run the other way.

🔥 Hot Take: It’s like The Big Short, but with better outfits and significantly more moral ambiguity.

Investing in T-Rex: Big Returns or Big Bones?

Wealth isn't just stocks; "passion assets" like fossils are booming. Collectors are treating ancient bones like blue-chip art, driving prices up for items that are literally dead assets.

While unique assets offer huge potential returns, they have zero liquidity. You can't sell a T-Rex femur to buy groceries quickly. Diversify, but maybe stick to assets that fit in a wallet.

Building wealth is a strange business. One minute you're analyzing semiconductor charts, the next you're reading about dinosaur auctions or money laundering in the Bahamas.

If there's one thing I've learned in my own journey—from staring at confusing option chains to navigating the ups and downs of business—it's that curiosity pays the best dividends.

The people who get ahead aren't just the ones who work hard; they're the ones who look at a pile of dinosaur bones or a confusing ETF and ask, "Wait, how can I make this work for me?"

So, go turn over some rocks this week. You might find a fossil, or you might just find a better way to manage your money. Either way, keep digging.

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃