#47 My Last Issue... Grab Your Free Gift!

Welcome back to our final newsletter of the year! 🎉

It’s been an incredible journey together, and I’m so grateful you’re here. Stick with me until the end — I’ve got a special gift just for you!

This week, we're diving into the financial world's secret weapon: The Poor Man's Covered Call (PMCC).

Unmask money myths that are stealing your potential, explore passive income ideas beyond your wildest dreams (like high-value sneakers!), and take a journey with the world's most seductive metal.

Ready to trade in that noisy property investment for "rent" from a stock? Keep scrolling—your bank account is begging you to before 2026 knocks on your door!

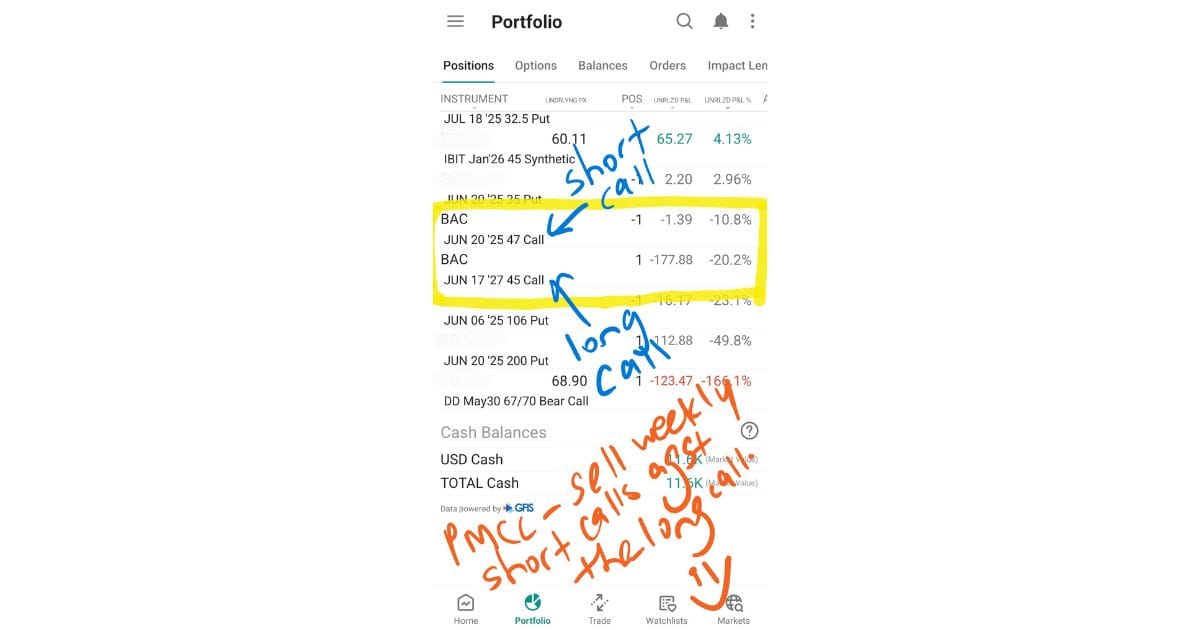

How I'm Collecting "Rent" from Bank of America

Remember all the stress and massive capital you'd need to start a rental property business?

Forget that! I stumbled upon the glorious—yet suspiciously goofy-sounding—Poor Man’s Covered Call (PMCC).

I know, it sounds like something unfortunate that happens at a cheap bowling alley, but it’s actually a genius options strategy that lets you mimic owning 100 shares of a stable stock—like Warren Buffett’s beloved BAC—without needing to sell a kidney upfront.

Here’s how it works: I buy a super long-dated call option (a LEAP) that acts as my “house,” and then I sell short-term calls against it, collecting weekly or biweekly “rent.”

My only tenant is my digital broker, and my worst maintenance issue is a slow WiFi connection. Since starting this BAC play, the consistent income has been rolling in.

Sometimes the clog happens when the price doesn't go my way but it's all good because I can be my own plumber and fix the mess by rolling the short call out or up before it causes real damage.

Here’s the twist: I almost never tried this strategy at all.

Why?

Because I was held hostage by a money myth I didn’t even know I had.

I grew up believing that “options are dangerous — only financial geniuses and Wall Street wolves should touch them.”

That myth sat in my head rent-free for years, quietly blocking opportunities.

If this struck a nerve, don’t miss the spotlight article below — it dives deeper into the money myths that secretly hold people back.

Once I ditched that outdated belief, the doors flew open.

Suddenly, I wasn’t just investing… I was collecting “rent” from Bank of America with zero leaky roofs, zero screaming tenants, and zero awkward text messages asking if I could “fix the water heater today.”

So ask yourself:

Kick it out — politely or aggressively, your choice — and that’s when the real wealth-building begins.

Overcome Limiting Beliefs About Wealth

💡 Your money mindset is the secret boss level of your finances; stop letting outdated, internalized beliefs sabotage your path to a richer life.

How To Use Social Media To Grow A Side Hustle Without Burning Out🔥 Ditch the "hustle culture" anxiety! The real key to growing your online income without losing your mind is smart strategy and consistent content, not viral luck.

15 Passive Income Ideas to Make Money While You Sleep

😴 Want your money to work 24/7? This list gives you everything from investing in index funds and REITs to setting up automated cash machines like vending machines or car washes.

Why Viral Success Isn't Paying Your Bills

📉 Going viral gives you a high, but sustained income comes from focusing on your core product, a niche audience, and strategic consistency, not chasing one-hit wonders.

How Tech is Disrupting the Real Estate Market in 2025

🏡 AI, Virtual Reality tours, and tokenization are making property investment more transparent and accessible—no need to be a mogul to own a piece of the pie anymore.

🎬 GOLD

A thrilling exploration of gold’s journey from ancient symbol of power to modern speculative asset—it’s like an Indiana Jones adventure, but rooted in real historical greed, fraud, and financial drama.

🎯 The Big Idea: Gold's value isn't just because it's shiny; its history is packed with political chaos, murder, and financial mayhem, making it the ultimate emotional, speculative "casino-chip" in times of crisis.

💡 Why It Matters: Understanding gold's enduring role as a global safe haven shows why it behaves differently than stocks and why central banks (and savvy investors) hoard it during economic uncertainty.

🚀 Action Step: Consider adding a small percentage of physical gold (or gold ETFs) to your portfolio as "insurance" against currency devaluation and market panic.

🔥 Hot Take: The movie proves that the "barbarous relic" is still the financial world's biggest diva—always demanding attention and skyrocketing in price the moment the global economy has a bad hair day.

Your Favorite Sneaker Might Be Your Next Investment Vault

The rarest, most iconic sneakers (like original Air Jordans) are a legitimate alternative asset class, appreciating in value due to extreme scarcity and cultural significance.

Treat highly limited-edition "grail" sneakers like art: buy what you genuinely love, understand its provenance, and see investment profit as a bonus, not the sole goal.

As the year wraps up, it’s the perfect time to pause and reflect on your financial journey. Whether you’ve been exploring new wealth-building strategies, testing side hustles, or learning how mindset shifts shape your money decisions, the key is taking action that aligns with your goals.

For those who’ve been opening my emails, thank you so much for sticking around! It’s been a year since I started this newsletter, and I’m grateful for how much I’ve grown—and I hope I’ve brought some value, maybe a laugh or two, to your journey as well!

To show my appreciation, I've prepared these Wealth Potpourri Mini Wealth Digests for you. Feel free to pick and choose what resonates, and I hope a little wealth nugget sparks inspiration and motivates you to take action—because if you don’t, no one else will.

In the coming new year, let’s light up those financial neurons: try a new investment, track your progress, or commit to just one smart money habit. Small, consistent steps turn curiosity into confidence and strategies into results.

Your wealth journey starts here—embrace the learning, spark those neurons, and make 2026 the year you take charge of your financial future.

To your wealth and beyond.

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃