#40 Millionaire Mindset Makeover for Wealth Builders

Are you dreaming of a home with a balcony while simultaneously wondering how to make your money work harder than you do?

This week, we're spilling the tea on how I turned a low-key industrial investment into a major win (yes, without ever visiting it—don't judge!).

We'll also dissect the mindset of millionaires, check out the new real estate crystal ball for 2025, peek behind the curtain of why content creators get burned out, and even learn a few things from a literal "Witch of Wall Street."

You'll want to keep scrolling—because what you don't know might be costing you a fortune!

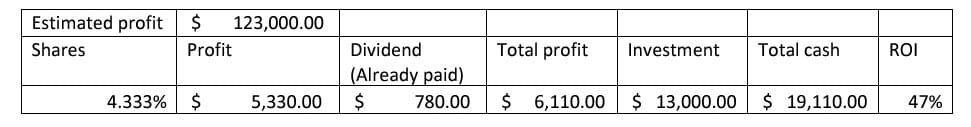

How My $13K Industrial Investment Turned Into a 47% Return

About five years ago, I had this simple dream — to own a nicer home so my family could enjoy a better quality of life. I imagined a place with a balcony where we could look out at greenery, breathe in fresh air, and just feel at peace.

That desire hit me especially hard during COVID, when all of us were confined within the same four walls for months. It made me realize how much our environment affects our well-being.

To afford that dream home, I knew I had to grow my money for the monthly instalments.

Around that time, I came across a property investment community that shared the ins and outs of how to profit from real estate — from spotting undervalued properties to analyzing market data. Intrigued, I invested nearly $3,000 for lifetime membership and access to a portfolio analyst who could guide me in building my property portfolio.

Through this community, I learned how to identify good opportunities — properties with solid fundamentals and profit potential from day one. I also met like-minded investors who were learning and growing together.

Then came the opportunity to make my first property investment — an industrial property that I saw as my “money tree” for the next few years. I decided to go in as a cash investor, putting in $13,000 alongside others. I figured that if I could make this work, it could help me eventually reach the home I’d been dreaming of.

For context, industrial properties are spaces used by businesses — things like warehouses, factories, or production units. They’re not for living in, but they’re often rented out to companies on long-term leases. Many investors like them because they can provide stable rental income and lower maintenance costs compared to residential properties.

Here’s the twist: I never once visited the property I invested in. I simply collected yearly interest and waited for capital appreciation — and four years later, my $13K grew into a 47% return. Spread over four years, that’s more than 10% per year!

Naturally, friends asked:

“How did you know this was safe?”

“What if it was a scam?”

“How could you trust them?”

Valid questions — and I had them too. But I did my homework:

- I knew someone personally in the community who had good experiences.

- The deal was shared openly in a public Telegram group.

- I met the organizer in person and verified her identity.

- The numbers made sense, especially during COVID when undervalued deals appeared.

Was there risk? Of course. But after doing my due diligence, the only logical next step was to move forward.

You can study and plan forever… but nothing changes until you take that first calculated step.

And here’s where thinking like a millionaire matters: Millionaires don’t wait for perfect conditions—they analyze, plan, and act. They see opportunities where others see risk. The mindset of calculated boldness, not reckless gambling, is what multiplies wealth over time.

If you’re also considering investing in actual properties instead of REITs, I hope my little story gave you something to think about — and maybe the nudge you need to move forward in your own wealth-building journey.

By the way, if you’d prefer exploring REITs instead, scroll on to find out more!

To your wealth and beyond.

Learn how institutions manipulate markets—and how to profit from it. Discover hidden signals, smart setups, and strategies that flip market chaos into consistent gains.

Think Like a Millionaire in 30 Days

🧠 Transform your money mindset step by step. From shifting scarcity thinking to building disciplined financial habits, this guide shows how your mindset can become your most powerful wealth-building asset.

Why Most Content Creators Go Broke and Give Up

🎥 Learn why passion alone isn’t enough to sustain a creator’s journey. Corey Wilks breaks down how to balance creativity with strategy so your dreams don’t drain your bank account.

REITs vs. Physical Properties: Which Is Right for You?

🏠 Should you buy a building or a share of one? Explore the pros and cons of REITs versus real property — from liquidity and control to returns and risk. The right pick depends on your wallet and your patience.

Step-by-Step Guide to Making Your First Affiliate Sale – 10KHits Blog

💸 Turn clicks into cash! This guide shows exactly how to choose the right affiliate offers, create irresistible content, and make that thrilling first sale — even if you’re just starting out.

Real Estate in Focus: 2025 Trends to Watch

📈 From smart buildings to green investing, the 2025 real estate landscape is shifting fast. Here’s what investors need to watch to stay ahead of the property curve this year.

Investing Newsletter for people who are looking for a faster retirement. The goal is to make a better return investing in blue chip companies.

🎬 GOODFELLAS

A classic mob movie about a kid who ditches the straight and narrow for a life of crime, learning a few "financial" lessons the hard way—like don't spend the loot on a pink Cadillac.

🎯 The Big Idea: The film is a masterclass in unregulated, high-risk capitalism. It shows how the lure of fast, untaxed money and status replaces honest work, but ultimately, the freedom is an illusion.

💡 Why It Matters: All that high-rolling crime eventually leads to a disastrous cash flow problem and reliance on an unstable, ruthless system. It's a vivid reminder that a sustainable income stream, however boring, beats a temporary, high-drama windfall.

🚀 Action Step: Look at your income sources: are they scalable and stable, or do they rely on you constantly looking over your shoulder (or running from the FBI)? If it's the latter, maybe rethink that "side hustle."

🔥 Hot Take: It’s the ultimate cautionary tale that proves the old saying: The only thing worse than paying taxes is having to go into witness protection to avoid them.

The "Witch" Who Outsmarted Wall Street (and Made Billions)

When markets panicked, she stayed calm, stocked cash, and scooped up undervalued assets. Her secret? Patience, courage, and a contrarian strategy.

Want to build your own “magic fund”? Learn how to spot opportunity when others freeze—and grow wealth with discipline.

I started this newsletter because, like many of you, I spent years feeling like I was just watching a financial movie, not starring in it.

That $13K leap into industrial property wasn't just about the returns; it was about proving I could do the research, face the fear, and act on a calculated plan.

The biggest wealth secret isn't a complex algorithm—it's getting off the bench.

So, ditch the noise of "get rich quick" schemes and focus on the steady drumbeat of smart action.

You don't need a magic wand to build wealth, just a good plan and the courage to execute it.

Your final mission: What is one small, calculated financial action you've been putting off? (And no, buying a lottery ticket doesn't count.)

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃