#36 Investing in Yourself: The Best ROI You’ll Ever Get

Ever taken a “shortcut” that turned into a whole adventure? That was me—skipping the ETF basics and diving straight into options with a $197 course.

Along the way, I discovered how mistakes can turn into income streams (hello, covered calls), and why investing in yourself pays the best dividends.

This issue, we’re exploring messy wins, clever strategies, and surprising wealth quirks that prove money is never boring.

My $197 Mistake... Or Was It?

Five years ago, I was on a mission to grow my money so I could "buy" a better life for my family.

I knew nothing about investing, and all the other courses were way out of my budget. Then, I found a 2.5-day options trading course for just $197—a steal!

I figured, hey, at least this was something I could afford—so I went for it. My initial strategy was simple: sell puts and collect that sweet, sweet premium. It worked! For a while.

I was making a modest monthly income, feeling like a genius. But then, the universe reminded me I was still a noob.

I got stuck with four stocks I had no business owning, assigned at prices nobody else wanted. Their value tanked, and I was left holding the bag, refusing to realize the loss.

Fast forward a few years, and I’ve picked up some new tricks. One strategy I now love is the covered call strategy—basically renting out my shares for extra income.

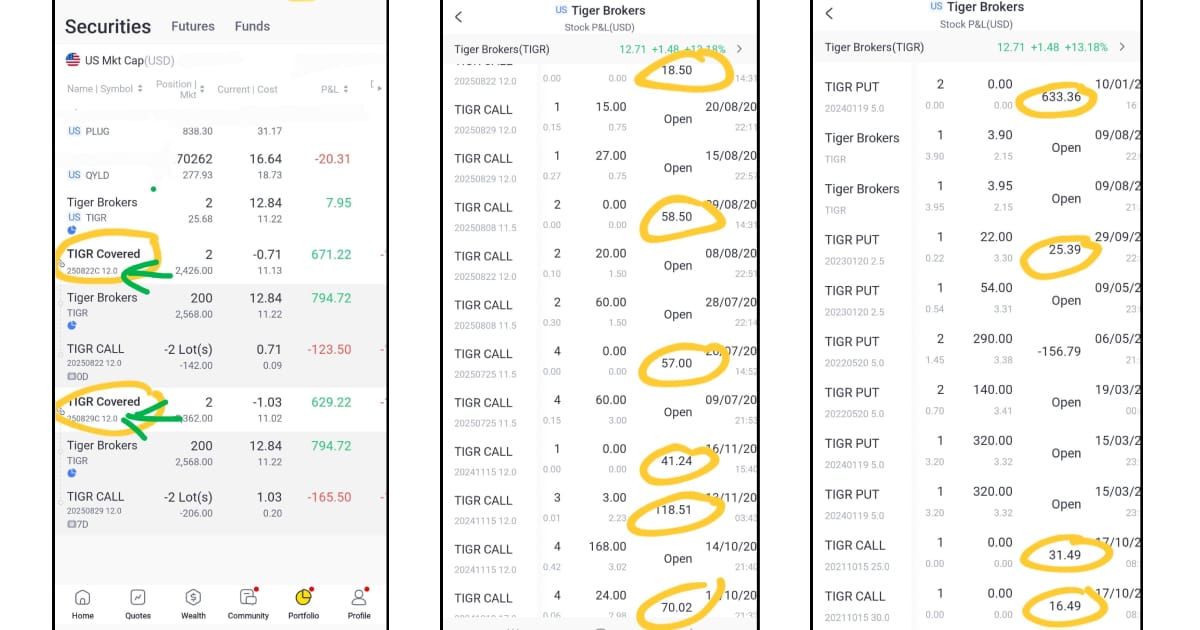

Check out the numbers I’ve circled in yellow—that’s the premium I collected.

Here’s how it works: I own the shares, I sell call options on them, and I pick a strike price that I’m actually willing to sell at.

If the stock trades above that strike on expiry, my shares get “called away,” which just means they’re sold at that agreed price.

If it stays below, I keep the premium—and then I simply rinse and repeat by selling another call.

For example, I own 400 TIGR shares. I sold covered calls on them with strikes at $12.

If you look at the first green arrow, it points to a contract code: 250822C 12.0. This code tells you the expiry date, the strike price, and the type of option (call or put).

|

Part of Code |

Meaning |

Explanation |

|

250822 |

Expiry Date |

Option expires on 22 Aug 2025 |

|

C |

Option Type |

Call option (right to sell your shares) |

|

12.0 |

Strike Price |

Price at which the shares can be sold ($12) |

So basically, it’s a shorthand that tells you exactly what you’re selling or buying in the options market.

Since my cost price is $11.22, even if the buyer takes them at $12, I still walk away with profits. Make sense?

That’s why I love options: so many strategies, and you only need to master a few to keep squeezing juice out of your capital.

Covered calls even helped me offload two of those “stuck” stocks I once regretted buying.

And along the way, I’ve been part of trading communities that made the learning curve a little less lonely.

I’ve mentioned Super Investor Club before, but I also follow Stock Market Genius.

What I like about it? Weekly deep dives into stocks and options ideas—saving me research time so I can spend more time on other things I love, like playing with my doggie 🐶.

What You Get as a Stock Market Genius Member

✅ Real-time trade ideas

✅ Weekly livestreams

✅ Top monthly stock picks

✅ Hands-on learning for all levels

✅ Access to a supportive community

For less than $2 a day (which I can easily earn back with a few option trades), I’m not only educating myself—it’s like hiring an online mentor who’s already done the heavy lifting of research for me!

So, what about you—are you investing in yourself and learning new skills, or are you still waiting for the “perfect time” to start?

Investing in Yourself: The Best ROI You’ll Ever Get

💡 Investing in yourself is the smartest move you can make, with a return that will always outpace the stock market. From upskilling to mental resilience, building your knowledge is the ultimate wealth-building strategy. It’s the one investment that never crashes.

Taxes for Content Creators: Stay IRS-Compliant

🤑 Navigating taxes as a freelancer can be a wild ride, but this article breaks it down so you don’t have to. Learn how to track expenses, understand deductions, and avoid an audit from the friendly folks at the IRS. Because nothing kills your creative mojo like a surprise tax bill.

Selling Covered Calls for Monthly Income

📈 Learn how to turn your stock holdings into a passive income stream with covered calls. This strategy allows you to earn premiums while you wait for a stock to hit your target price. It’s like getting paid to wait, which is a lot more fun than just... waiting.

Best Work From Home Jobs: No Experience Needed

💰 Looking for a way to make money from the comfort of your couch? This article lists a bunch of flexible jobs you can start with little to no experience. From virtual assistant work to transcription, there are plenty of options to boost your income without leaving your pajamas.

How to House Hack: 5 Steps I’ve Used Successfully

🏠 Ever wanted to live for free? House hacking shows you how to buy a multi-unit property, live in one unit, and rent out the others to cover your mortgage. It’s a genius way to build equity and slash your living expenses, turning your home into a cash cow instead of a money pit.

Our mission: To help people discover the best financial products, increasing both their knowledge and wealth.

📚 ENRON: THE SMARTEST GUYS IN THE ROOM

More thrilling than any fictional heist movie, this book chronicles the spectacular rise and fall of Enron. It’s a masterclass in what happens when ambition, greed, and a total disregard for the law collide.

🎯 The Big Idea: Enron's leaders used complex accounting schemes and off-balance-sheet partnerships to hide billions in debt and inflate profits. It's a deep dive into corporate fraud and the human cost of a house of cards.

💡 Why It Matters: This isn’t just a cautionary tale; it's a stark reminder that even the "smartest guys in the room" can get it horribly wrong. It highlights the importance of financial transparency, corporate governance, and not trusting your company's leaders just because they have big titles.

🚀 Action Step: Always do your own research on a company's financial statements before you invest, and don't get swept up in the hype. If something sounds too good to be true, it probably is.

🔥 Hot Take: This proves that the greatest financial drama isn’t on Wall Street, but in the conference rooms where people are actively trying to deceive the rest of us. It’s like a true-crime story for finance nerds.

John D. Rockefeller's Quirky Ledger

The richest person in modern history had a peculiar habit! John D. Rockefeller, despite his immense wealth, meticulously recorded every single expense, even a five-cent tip, in a personal ledger.

This shows that building wealth isn't just about making money but also about respecting every dollar you earn and tracking where it goes. Every cent counts, even when you have billions.

From Enron’s cautionary tale to Rockefeller’s quirky ledger, the message is clear: wealth is built on curiosity, resilience, and squeezing lessons out of every dollar (or mistake).

My own experience taught me that education is the highest-return investment—and it doesn’t always come from a textbook.

So, what about you—what’s the “wild card” lesson you’ve picked up on your wealth journey?

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃