#31 How to Stay Motivated on Your Wealth Journey

I want to share a few things I’ve been learning about making money work better for us.

The spotlighted articles touched on ideas I’ve struggled with and others I’m still figuring out — hopefully, they give you a little boost or fresh perspective as well.

My Journey Into Synthetic Trading (And Why It Changed the Way I Trade)

When I first got into options, I mainly sold puts. Later on, I learned to buy calls. Then I graduated to vertical spreads, which became one of my favorites. Much later, I picked up another powerful strategy called the synthetic.

So yes—it’s been a step-by-step journey, kind of like leveling up in a video game.

Now, when you hear the word synthetic, you might think of fake leather jackets. But unlike those, these synthetics don’t just look good—they actually work.

In trading, synthetics let you mimic owning an asset without actually buying it.

All it takes is a combo move: Buy a call, sell a put. Same strike, same expiry—and you’ve basically created a “synthetic stock.”

Think of it like renting a house but still collecting rent from tenants. You don’t own the place outright, but you get most of the perks without paying the full price tag.

Why I love them?

- You usually need less capital than buying shares outright.

- They give you flexibility to tweak your setup.

- You can tailor them to different market conditions.

And here’s the kicker: by pairing this with selling calls for income, it has become one of my favorite money-making strategies.

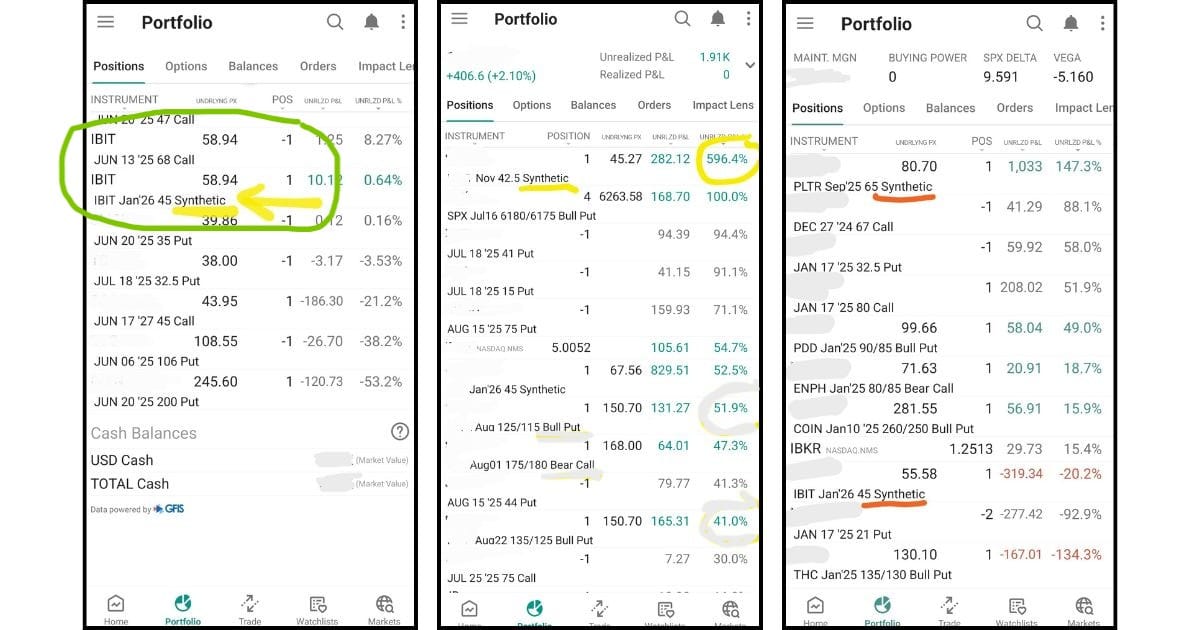

Take a look at my IBIT example (IBIT Jan'26 45 Synthetic):

- I’ve got a long call and a short put on IBIT, both at strike $45, expiring in 2026.

- That combo acts just like holding 100 shares—but without coughing up $4,500.

- In fact, my short put premium helped pay for most of my call, so the net cost was only a fraction of that.

With this “synthetic stock” in place, I then sell weekly calls to collect premium after premium.

In the example above, I sold a call at $68 expiring 13 June 2025 (IBIT Jun 13 '25 68 Synthetic). Here’s what happens:

- If IBIT stays below $68 by expiry → I just keep the premium (free money snack).

- If IBIT climbs above $68 → my synthetic gets “called away.” That means my upside is capped at $68.

But here’s the good part: my synthetic strike is at $45. So even if I get capped at $68, I’m still sitting comfortably in the profit zone. I just won’t capture gains beyond $68—fair trade for the steady income I’ve been pocketing along the way.

Traders give this strategy fancy names like:

- Synthetic covered call

- Covered call on synthetic stock

- Or simply a buy-write (synthetic edition)

Is it a good strategy? Like most things in trading—it depends.

✅ Pros:

- Steady income from selling calls.

- Great in sideways or gently bullish markets.

- Requires less upfront cash than buying shares outright.

⚠️ Cons:

- Caps your upside if the stock rockets.

- Your synthetic long can suffer if volatility drops hard.

- Margin on the short put can be chunky.

- You’re essentially stacking leverage, so risk management is non-negotiable.

Bottom line: it’s fantastic if you expect moderate bullishness without crazy rallies. Not so great if you’re chasing moonshots.

I actually picked this up when I joined Super Investor Club. Not saying this to do a promo—it’s just genuinely where I first learned about synthetics and actually applied it on a stock.

Cuz the one thing I’m still working on is researching and knowing exactly when and which stock to apply strategies on—but I’m learning. Meanwhile, it really helps to have some guidance to accelerate my learning and, in turn, my profits.

By the way, you might be wondering—what’s IBIT?

Think of it as Bitcoin wrapped in a stock. It’s a Bitcoin ETF, which means you can buy and sell it on the stock market just like any other share—no wallets, no private keys, no crypto exchange drama.

Perfect for anyone curious about Bitcoin but not ready to dive into the deep end of actually holding it.

Back to Super Investor Club—the focus here is on quant research. In other words, using data, math, and backtesting to drive trades. No guessing, just high-probability setups grounded in real numbers.

I learnt how to apply synthetics in different scenarios—and more importantly, why they work. Their weekly lessons, live signals, and curated strategy hub gave me the structure I needed to start trading with real confidence.

Here’s what I love most:

✅ I understand every trade before I take it

✅ I follow strategies that are statistically sound

✅ I’m part of a community that shares real-time ideas and insights

If you're tired of winging your trades or burning cash on hype, check them out.

Grab a free 2-week trial today—then just $1.30/day if you stick around. Get real insights to help you trade smarter, starting now. Don’t miss out (again).

This journey showed me that smart trading isn’t about being a genius—it’s about having the right tools, the right strategy, and the right people around you. That’s how I stay motivated on my wealth-building path.

Let’s trade smarter—not harder.

To your wealth and beyond.

Get into The Bitcoin Mining Block Post for mining economics, cutting-edge business strategies, and insights into the latest trends & innovations.

How To Stay Motivated for Your Wealth Journey

💡 Staying motivated on your path to financial freedom isn’t always easy. This article shares practical tips to keep your focus, overcome setbacks, and celebrate small wins along the way.

Cash vs Card: Which Saves You More?

💳 Explore the surprising truths behind saving money with cash versus cards, plus smart ways to optimize your spending habits for better financial control.

Understanding Synthetic Options: A Beginner’s Guide

📈 Dive into synthetic options — a clever strategy that mimics stock ownership using options contracts, potentially boosting your trading flexibility and returns.

$14K Passive Income: A Self-Made Millionaire’s Side Hustle Secrets

💰 Discover how a self-made millionaire generates $14,000 every month from multiple passive income streams — plus practical advice on building your own.

Residential vs Commercial Properties: Which is the Better Investment?🏢 Unpack the pros and cons of residential versus commercial real estate investing so you can decide which path fits your wealth-building goals best.

Every morning, get a confidential email with a list of the fastest-moving stocks based on world news and current events.

🎬 THE CHINA HUSTLE

A gripping documentary exposing massive financial fraud in Chinese companies listed on U.S. exchanges, and the costly fallout for investors.

💡 The Big Idea: Markets can be manipulated at a global scale, and uncovering these frauds can save you from costly mistakes.

🌍 Why It Matters: Reminds investors to do deep due diligence and question seemingly “too good to be true” investments, especially in emerging markets.

🛠️ Action Step: Always check for transparent financial reporting and independent audits before investing in foreign companies.

😂 Hot Take: This film makes stock market scandals feel like a thriller — popcorn recommended.

How a $20 Domain Became a Multi-Million Dollar Jackpot

In 1994, Chris Clark registered the domain pizza.com for $20, envisioning it as a tool to attract pizza-related clients to his consulting firm.

What began as a modest investment turned into a multimillion-dollar sale, highlighting the potential value of early internet domain acquisitions.

I won’t lie — this journey hasn’t been perfect. I’ve had my share of mistakes and moments where I wanted to give up. But every small win made it worth sticking with.

I started Wealth Potpourri because I wanted a place to share the real stuff — the wins, the lessons, and the ideas that keep me going.

What’s one thing you’ve tried lately that surprised you?

P.S. Some links in here are affiliate links for tools and wealth-building products I personally use and love. If you snag something through one of them, you'd score a sweet deal and I'd get a perk—at no extra cost to you. Thanks for helping to keep the potpourri fresh!🍃